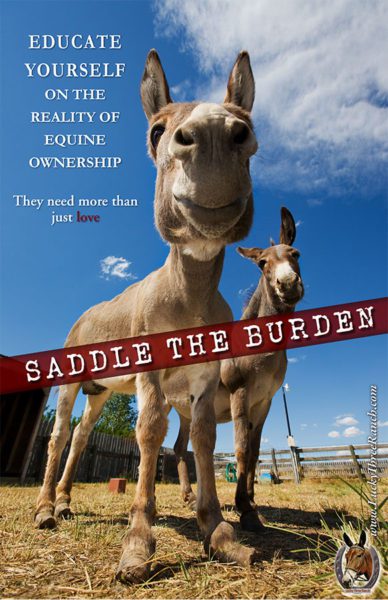

Download a PDF of

the poster (right)

The One Where We Share the Friends Story, Again

The following is from All About Equine Rescue: As we count down to 2024, join us every day this month as we share stories from the barn that show how your support has helped horses this year and every year. We've been sharing stories mostly about individual horses, but today we're going to pivot to this group of Friends. In August 2023, AAE welcomed Ross, Rachel, Monica, Chandler, and Joey after the unexpected death of a family member. The Friends had been loved and well cared for by the family, but resources were now limited, and the family needed help. The Friends had been together for many years, so before coming to AAE, efforts were made to rehome them together ...

Chilly Pepper – ONE LAST EMERGENCY SAVE for 2023! Jasmine needs our help now!

The following is from Chilly Pepper - Miracle Mustang: Happy New Year WE NEED TO SAVE ONE MORE LIFE FOR 2023! I received a 911 call for this beautiful mare about an hour ago. She was at the Eugene auction, and this was her description: 7yr old grey mare - BITER, KICKER, STRIKER THAT DESCRIPTION IS BASICALLY A DEATH SENTENCE, especially when so many healthy, ridable horses are being dumped daily. So Jasmine, (that is the name she told me) either has some serious issues, which may be caused by people, or maybe someone dumped her and just wanted her to go to slaughter. WE HAD TO SAVE HER! Her bail was cheap, I believe it was $160? However, that is the "free part" ...

Dapper Dakota

The following is from All About Equine Rescue: As we count down to 2024, join us every day this month as we share stories from the barn that show how your support has helped horses this year and every year. Dakota is enjoying a happy holiday this year! He's looking forward to a bright future for years to come with his forever person while reuniting with one of his brothers! DAKOTA Dakota is a 2009 tribal/reservation mustang originally from the Dakotas. He came to AAE from a distressed sanctuary with several other horses. His original, loving owner was diagnosed with terminal cancer, resulting in Dakota being placed at the former sanctuary. That sanctuary was struggling and needed assistance with its ...

The Marvelous Matteo!

The following is from All About Equine Rescue: As we count down to 2024, join us every day this month as we share stories from the barn that show how your support has helped horses this year and every year. We hope you had a wonderful holiday weekend. Christmas may be over, but we still have stories to share! Marvelous Matteo is up next! MATTEO AAE welcomed 10-year old (captive bred) mustang stallion, Matteo, in September 2023. He had an enormous summer sore on his face. (Summer sores are associated with the life cycles of stomach worms and transmitted by flies). Matteo was fearful and extremely reactive to humans, and no one at his prior home had been able to ...

The Best Christmas Gift Ever!

The following is from All About Equine Rescue: As we count down to 2024, join us every day this month as we share stories from the barn that show how your support has helped horses this year and every year. This year Elliott received the best Christmas gift ever, and his story is one of our favorites! He's healthy, happy, and with his new family! ELLIOTT Elliott is a captive bred mustang born in March 2021. He was rescued as a colt by a local family from a backyard breeder who said Elliott needed "a little" cosmetic surgery. The family soon realized the surgery would be more complicated and costly than they could manage, so they reached out to AAE ...

Granger is Going to Have the Hap-Hap-Happiest Christmas!

The following is from All About Equine Rescue: As we count down to 2024, join us every day this month as we share stories from the barn that show how your support has helped horses this year and every year. He may not be a Griswold, but Granger is going to enjoy a fun old-fashioned family Christmas in his new home this year! GRANGER Granger was living with a small herd of horses in a large, dry pasture. He is a senior (born ~1992) horse with very worn out teeth, and he was left to survive on dry weeds. He became emaciated, and fortunately, in the summer of 2022, law enforcement stepped in before it was too late. ...